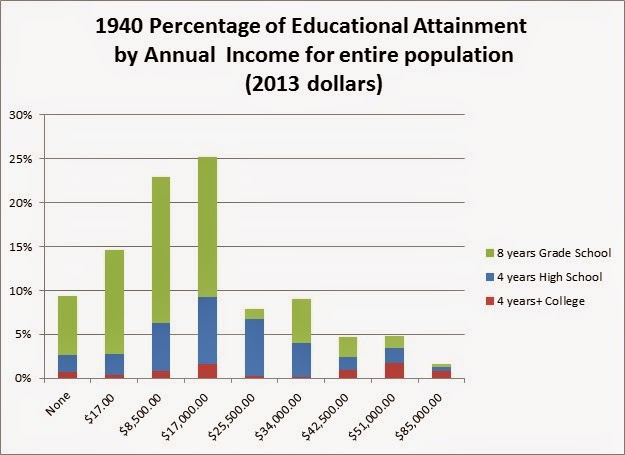

The problem with this question is one of definitions and how we measure the value of things. A college degree is inherently something good in nature as such it should hold some significant value to both the individual holding the degree and the society at large. In theory, the knowledge gained from a college degree should allow the individual to obtain work associated with said knowledge, but in our capitalistic market system this is not guaranteed. Further, it is a mere social convention of recent times that those with college education should be paid more than those with say a high school education. There are no laws compelling businesses to pay according to this norm, except the minimum wage which is currently set at $7.25 an hour as the federal minimum (some states can have higher). To help illustrate this point I have included two graphs from the 1940 on educational attainment vs. wages paid.

As the Chart 1 shows when the 1940 census data is charted as the percentage of the total population per income bracket by educational attainment it becomes very clear that having a college degree should earn you more money. Those with such degrees clearly occupy a much greater percentage of the highest income bracket at that time, and thus supporting the current thesis that college education gets you more income.

Chart 1- Source: U.S. Census (1) & Bureau of Labor Statistics for dollar conversion (2).

But when you chart this same data (see Chart 2) so as to see the distribution of income with in the society as whole by educational attainment you come up with a different picture. You quickly realize that majority of people in 1940 were making $8,500 to $17,000 2013 Dollars per year. In fact a careful examination of the data reveals that those with college education seem to be split into two groups. One group making the normal wage that most of the populace is making and then a group making a lot more.

Chart 2- Source: U.S. Census (1) & Bureau of Labor Statistics for dollar conversion (2).

The problem is trying to do this kind of analysis with current data is not truly possible because the information is typically arranged in a statistical bell-curve pattern using median values. As such to tease out the data represented in Chart 2 is much more difficult, if not nearly impossible.

What can be done is comparing ranges and medians of the groups (see Chart 3). As such can see some overlay of income brackets, but since the median value represents the 50% mark it is hard to tell if there are truly more people in the higher end or lower end since it is nice smoothed bell-curve. What can be told is there does appear to be some overlap between the two educational degrees suggesting that it is possible that for someone with a bachelor degree to earn just as much as the median income of a high school degree. I suspect if the true population values were known per income groupings that we would no doubt see more of a curve similar to that of 1940.

Chart 3- Source: Bureau of Labor Statistics (2 & 3).

If anything what this information is more suggestive is that there are two major groups of people living and working in the U.S. currently. One group which is an overwhelming majority of the people earning pretty much the same wage regardless of educational attainment, and another group earning vastly much more and having higher education overall in comparison to the rest of the populace.

So does it mean is a college loan is worth all the trouble? I have to answer that I don’t think so, not really because of the possibility of not earning the median or higher wage amounts, but chiefly because of reasons mentioned in this and previous post concerning this type of loan. This is a loan that you can only get out of through death should something go wrong with the ability to pay. You cannot even try to “re-sell” the object you bought with the loan because it is just for you alone. That kind of loan is not worth any hope of better life, because you in the end become a slave to such a debt and such a life will be fraught with potential hardship.

It is far better to try one’s best to pay as you go, using any free money one can get (i.e. grants, grandparent’s paying for tuition, etc.). Sure this method may take you longer, but in the end you will have more freedom than one chained to debt.

Citations

(1) U.S. Census (1940). Table 2 - Wage or Salary Income in 1939, For Native White Males 25 To 64 Years Old Without Other Income, By Years of School Completed and Age, For The United States, Urban and Rural-Nonfarm: 1940. CPS Data on Educational Attainment: Educational Attainment. Data. Retrieved on 5-10-14 from http://www.census.gov/hhes/socdemo/education/data/cps/1946/p46-5/tables.html

(2) Bureau of Labor Statistics (2014). Consumer Price Index- All Urban Consumers. Series ID: CUSR0000SA0. Databases, Tables & Calculators by Subject. Data. Retrieved on 5-10-14 from http://www.bls.gov/data/

(3) Bureau of Labor Statistics (2014). (unadj)- Usual weekly earnings (first decile), Employed full time, Wage and salary workers, High school graduates, no college, 25 years and over. Series ID: LEU0252917100. Databases, Tables & Calculators by Subject. Data. Retrieved on 5-10-14 from http://www.bls.gov/data/

(3) Bureau of Labor Statistics (2014). (unadj)- Usual weekly earnings (first quartile), Employed full time, Wage and salary workers, High school graduates, no college, 25 years and over. Series ID: LEU0252917200. Databases, Tables & Calculators by Subject. Data. Retrieved on 5-10-14 from http://www.bls.gov/data/

(3) Bureau of Labor Statistics (2014). (unadj)- Median usual weekly earnings (second quartile), Employed full time, Wage and salary workers, High school graduates, no college, 25 years and over. Series ID: LEU0252917300. Databases, Tables & Calculators by Subject. Data. Retrieved on 5-10-14 from http://www.bls.gov/data/

(3) Bureau of Labor Statistics (2014). (unadj)- Median usual weekly earnings (second quartile), Employed full time, Wage and salary workers, High school graduates, no college, 25 years and over. Series ID: LEU0252917300. Databases, Tables & Calculators by Subject. Data. Retrieved on 5-10-14 from http://www.bls.gov/data/

(3) Bureau of Labor Statistics (2014). (unadj)- Usual weekly earnings (third quartile), Employed full time, Wage and salary workers, High school graduates, no college, 25 years and over. Series ID: LEU0252917400. Databases, Tables & Calculators by Subject. Data. Retrieved on 5-10-14 from http://www.bls.gov/data/

(3) Bureau of Labor Statistics (2014). (unadj)- Usual weekly earnings (ninth decile), Employed full time, Wage and salary workers, High school graduates, no college, 25 years and over. Series ID: LEU0252917500. Databases, Tables & Calculators by Subject. Data. Retrieved on 5-10-14 from http://www.bls.gov/data/

(3) Bureau of Labor Statistics (2014). (unadj)- Usual weekly earnings (first decile), Employed full time, Wage and salary workers, Bachelor's degree only, 25 years and over. Series ID: LEU0252918900. Databases, Tables & Calculators by Subject. Data. Retrieved on 5-10-14 from http://www.bls.gov/data/

(3) Bureau of Labor Statistics (2014). (unadj)- Usual weekly earnings (first quartile), Employed full time, Wage and salary workers, Bachelor's degree only, 25 years and over Series ID: LEU0252919000. Databases, Tables & Calculators by Subject. Data. Retrieved on 5-10-14 from http://www.bls.gov/data/

(3) Bureau of Labor Statistics (2014). ((unadj)- Median usual weekly earnings (second quartile), Employed full time, Wage and salary workers, Bachelor's degree only, 25 years and over. Series ID: LEU0252919000. Databases, Tables & Calculators by Subject. Data. Retrieved on 5-10-14 from http://www.bls.gov/data/

(3) Bureau of Labor Statistics (2014). (unadj)- Usual weekly earnings (first quartile), Employed full time, Wage and salary workers, Bachelor's degree only, 25 years and over Series ID: LEU0252919100. Databases, Tables & Calculators by Subject. Data. Retrieved on 5-10-14 from http://www.bls.gov/data/

(3) Bureau of Labor Statistics (2014). (unadj)- Usual weekly earnings (third quartile), Employed full time, Wage and salary workers, Bachelor's degree only, 25 years and over. Series ID: LEU0252919200. Databases, Tables & Calculators by Subject. Data. Retrieved on 5-10-14 from http://www.bls.gov/data/

(3) Bureau of Labor Statistics (2014). (unadj)- Usual weekly earnings (ninth decile), Employed full time, Wage and salary workers, Bachelor's degree only, 25 years and over. Series ID: LEU0252919300. Databases, Tables & Calculators by Subject. Data. Retrieved on 5-10-14 from http://www.bls.gov/data/